Snap Inc, the company that owns picture- and video-sharing app Snapchat, is planning an initial public offering that could value the company at a minimum of $25bn, according to a report in the Wall Street Journal.

If the report proves true, the share sale would be the largest on a US stock exchange since 2014, when Chinese e-commerce service Alibaba was first listed at a value of $168bn.

Founder and CEO Evan Spiegel, 26, recently renamed the company Snap Inc. According to Forbes he is now worth $2.1bn.

The four-year-old company is expected to generate $366.7m in worldwide ad revenue, according to business data firm eMarketer; the estimate is based on the company’s own reports to stakeholders of its expected growth. Last year the company’s total revenue was a fraction of that number at $60m. It’s not clear whether or not Snap turns a profit.

The service, notably popular with younger people, allows users to send pictures and videos of them wearing virtual dog noses, make them look like zombies or swap faces with their friends. It has around 58 million users.

It has proved a hit with marketers too who have used it to promote their products with specially designed filters.

An IPO at $25bn would prove a big win for Spiegel who publicly rejected a $3bn bid for the service from Facebook in 2013. The social network acquired competing photo app Instagram for $2bn in 2012 and has recently changed Instagram to include Snapchat-like features, such as the ability to upload a string of short, linked videos.

The company has dramatically increased in value. During its last funding round in May, Snap’s valuation was pegged at $17.8bn. Among new investors in the company was Sequoia Capital of Menlo Park, California, a venture capital firm notable for its investments in businesses including YouTube, Google, Oracle and Yahoo.

There have also been concerns about the company’s high value. Last year Fidelity marked its own shares in the company down 25%, effectively wiping billions off the company’s valuation by itself. It has since revalued its shares at its original purchase price.

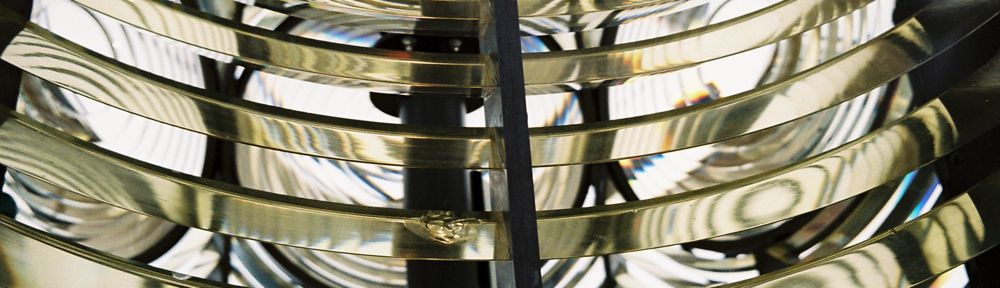

In September the company announced it was expanding its business beyond the app to launch Spectacles, glasses that can record 10-second clips that can be sent to smartphones. Snap Inc’s first hardware product will be available in US in time for Christmas priced $130.