Nearly $64m in bitcoin has been stolen by hackers who broke into Slovenian-based bitcoin mining marketplace NiceHash.

The marketplace suspended operations on Thursday while it investigated the breach, saying it was working with law enforcement as “a matter of urgency” while urging users to change their passwords.

The hack was “a highly professional attack with sophisticated social engineering” that resulted in approximately 4,700 bitcoin being stolen, worth about $63.92m at current prices, said NiceHash head of marketing Andrej P Škraba.

Bitcoin is a 'cryptocurrency' – a decentralised tradeable digital asset. Invented in 2008, you store your bitcoins in a digital wallet, and transactions are stored in a public ledger known as the bitcoin blockchain, which prevents the digital currency being double-spent.

Cryptocurrencies can be used to send transactions between two parties via the use of private and public keys. These transfers can be done with minimal processing cost, allowing users to avoid the fees charged by traditional financial institutions - as well as the oversight and regulation that entails. The lack of any central authority oversight is one of the attractions.

This means it has attracted a range of backers, from libertarian monetarists who enjoy the idea of a currency with no inflation and no central bank, to drug dealers who like the fact that it is hard (but not impossible) to trace a bitcoin transaction back to a physical person.

The exchange rate has been volatile, with some deeming it a risky investment. In January 2021 the UK's Financial Conduct Authority warned consumers they should be prepared to lose all their money if they invest in schemes promising high returns from digital currencies such as bitcoin.

In practice it has been far more important for the dark economy than it has for most legitimate uses. In November 2021 it hit a record high of more than $68,000, as a growing number of investors backed it as an alternative to other assets during the Covid crisis.

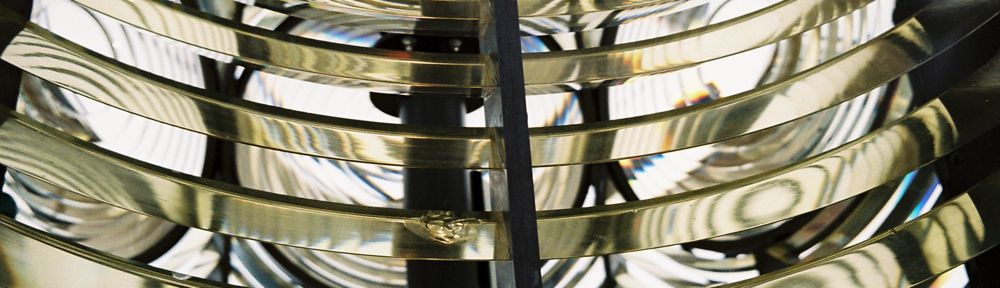

Bitcoin has been criticised for the vast energy reserves and associated carbon footprint of the system. New bitcoins are created by “mining” coins, which is done by using computers to carry out complex calculations. The more bitcoins that have been "mined", the longer it takes to mine new coin, and the more electricity is used in the process.

NiceHash is a digital currency marketplace that matches people looking to sell processing time on their computers for so called miners to verify bitcoin users’ transactions in exchange for the bitcoin.

Troubles with the website over the past day or so drew alarm and complaints, with many bitcoin owners posting panicked comments on NiceHash’s social media accounts.

NiceHash said in a statement: “We understand that you will have a lot of questions, and we ask for patience and understanding while we investigate the causes and find the appropriate solutions for the future of the service.”

The price of bitcoin has surged to more than $14,668, gaining around $2,000 (£1,494) of value in a day according to bitcoin monitor CoinDesk. That compares with a value below $1,000 at the beginning of the year.

Online security is a vital concern for cryptocurrency marketplaces and exchanges, with bitcoins contained within digital wallets that have increasingly become a target for hackers as the number of bitcoins stored and their value has skyrocketed over the last year.

In Japan, following the failure of bitcoin exchange Mt Gox, new laws were enacted to regulate bitcoins and other cryptocurrencies. Mt. Gox shut down in February 2014 having lost approximately 850,000 bitcoins, potentially to hackers. Mark Karpelès, head of Mt Gox, went on trial in Japan in July, facing up to five years in jail under charges of embezzlement and the lost of $28m of user funds.

- Everything you wanted to know about bitcoin but were afraid to ask

- Bitcoin mining consumes more electricity a year than Ireland